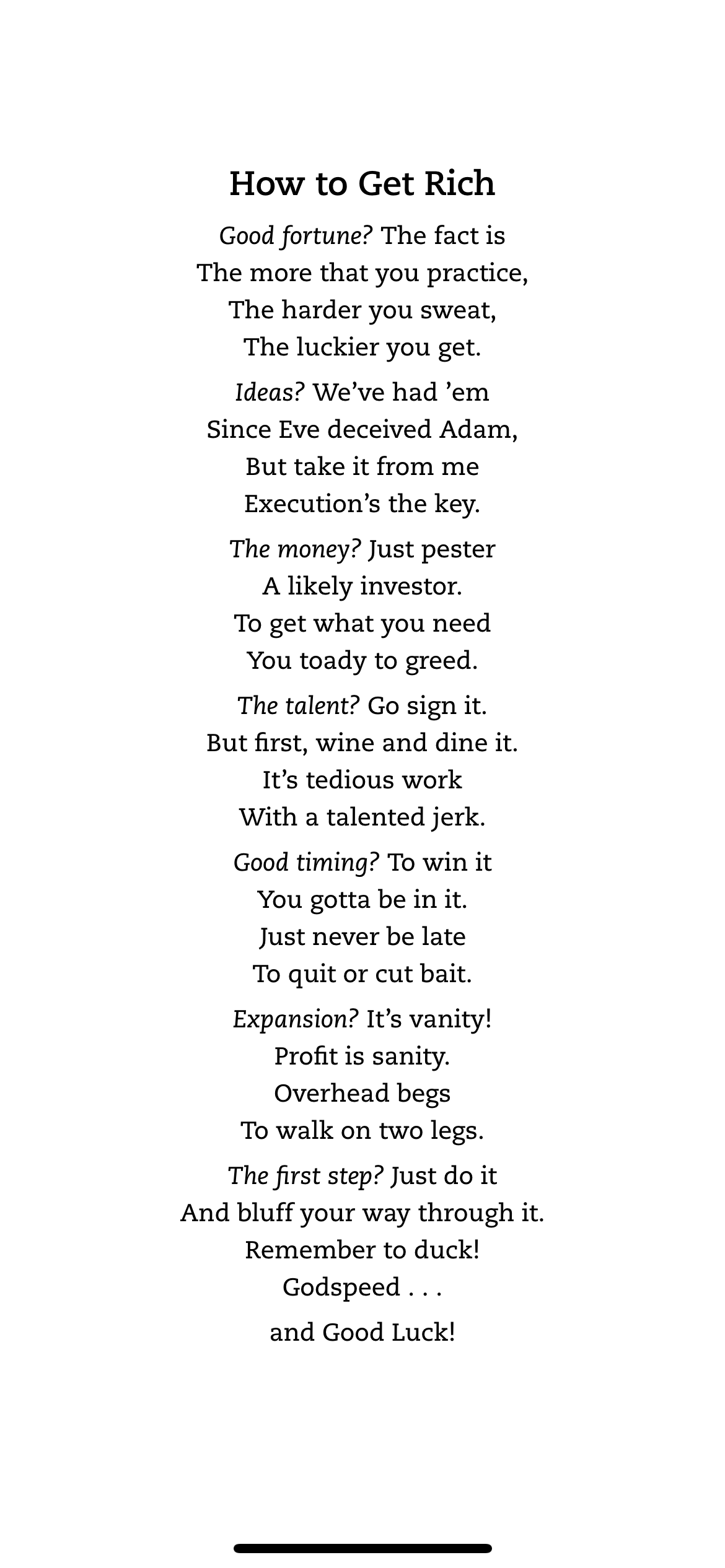

How To Get Rich: One of the World's Greatest Entrepreneurs Shares His Secrets

Reference https://www.felixdennisfoundation.com

TLDR;

The Eight Secrets to Getting Rich:

- Analyze your need. Desire is insufficient. Compulsion is mandatory.

- Cut loose from negative influences. Never give in. Stay the course.

- Ignore “great ideas.” Concentrate on great execution.

- Focus. Keep your eye on the ball marked “The Money is Here.”

- Hire talent smarter than you. Delegate. Share the annual pie.

- Ownership is the real “secret.” Hold on to every percentage point you can.

- Sell before you need to, or when bored. Empty your mind when negotiating.

- Fear nothing and no one. Get rich. Remember to give it all away.

You will never get rich if:

- you care what your neighbors think

- you’re unwilling to fail, even catastrophically

- you cannot face up to your fear of failure

- cannot bear the thought of causing worry to your family

- you’re worried about your artistic inclinations degrading along the way

- you’re not prepared to work longer hours than almost anyone you know

- you cannot convince yourself that you’re good enough to be rich

- you cannot treat your quest to get rich as a game

A few summarized tips

• Make your own luck

• Don’t whine or ever describe yourself as “unlucky.” (You’re alive, aren’t you?)

• Be bold. Be brave. Don’t thank your lucky stars. The stars can’t hear you.

• Stay the course. Stop looking for the green grass over the hill.

• Don’t try to do it all yourself. Delegate and teach others to delegate.

• Remember that most predators are lucky most of their lives, unlike their prey.

• Whiners and cowards die a hundred times a day. Be a hero to yourself.

• If being a hero isn’t your style, then fake it. Reality will catch up eventually.

• Just do it. It is much easier to apologize than to obtain permission.

• Never take the quest for wealth seriously. It’s just a game, chum.

• Next time you bump into Lady Luck, giver her a whack on the rump from me.

• Be lucky. Get rich. Then give it all away. (We’ll get to that bit later.)

You must have compulsion for it

Most people seek job security, job satisfaction and power over others far more than they seek wealth.

…

Do not mistake desire for compulsion. Only you can know the song of your inner demons. Only you can know if you are willing to tread the narrow, lonely road to riches. No one else can know. No one else can tell you either to do it or to refrain from the attempt. When the going gets tough, when all seems lost, when partners and luck desert you, when bankruptcy and failure are staring you in the face, all that can sustain you is a fierce compulsion to succeed at any price.

…

You must choose. Life is comfortable enough in the Western world for most people. In most parts of Europe there are the safety nets of the social services and of government-subsidized medical care. There are decent jobs at decent salaries with decent colleagues and a decent retirement; and all without the heart-stopping fear of bankruptcy, of years of risk amid fears of ignominious failure. Why do handstands on the rim of hell? Why bother to punish yourself in such a way? Nobody else does it—why should you? Go on, make everyone around you happy. Why not give in? If you are merely a wannabe, then the siren voices will prevail, and they will be right to prevail. If you are a gonnabe, then they will not prevail. Like Odysseus you will stop your ears with wax or bind yourself to the mast. You will learn to walk your narrow, lonely road—and to hell with the siren voices. You will not give in. And you will be rich.

…

By continually wishing and never delivering, you risk denting your confidence, beginning a vicious downward spiral that appears to draw misfortune like a magnet. The assumption that you might be able to achieve some goal if you only wished hard enough is not just a f***-up. It’s a potential personal tragedy.

…

Never yet have I met a self-made rich man or woman whose family or personal relationships were not plagued by the burden of creating a fortune, even a small fortune. A rocky marriage; lack of time spent with their children; the substitution of expensive gifts to repress guilt created by their frequent absences from home; the concern that their children have grown used to privilege and are consequently slacking in their education or lacking in ambition—all of these come as part and parcel of self-made wealth. There is no escape, although each of us believes we can be the exception that proves the rule. Is this a price you are prepared to pay?

Fear of failure is #1 obstacle

I am convinced that fear of failing in the eyes of the world is the single biggest impediment to amassing wealth.

…

Knowing that fear of failure is holding you back is a step in the right direction. But it isn’t enough, because knowing isn’t doing.

…

You may let yourself down if you do not act. And just how calamitous will utter failure prove to be, in any case?

…

If you are unwilling to fail, sometimes publicly, and even catastrophically, you stand very little chance of ever getting rich.

Execution is king

The follow-through, the execution, is a thousand times more important than a “great idea.” In fact, if the execution is perfect, it sometimes barely matters what the idea is. If you want to get rich, don’t sit around waiting for inspiration to strike. Just get busy getting rich.

…

Having a great idea is simply not enough. The eventual goal is vastly more important than any idea. It is how ideas are implemented that counts in the long run.

…

Good ideas are like Nike sports shoes. They may facilitate an athlete who possesses them, but on their own they are nothing but an overpriced pair of sneakers. Specially adapted sneakers may be a good idea. But the goal is still to win, and sports shoes don’t win. Athletes do.

…

Ideas don’t make you rich. The correct execution of ideas does.

…

Ideas, by the way, cannot be “owned” by anyone. You cannot trademark or patent or copyright any idea. You can only protect the execution of the idea and trademark the name. This is an important thing to know in any business and is often misunderstood by people who come to you with an idea. Such people often request you sign an NDA (a Non-Disclosure Agreement), and I am usually happy to do so.

Originality isn’t essential

If you want to be rich, then watch your rivals closely and never be ashamed to emulate a winning strategy. They may josh you a little for doing it, but that’s a price well worth paying.

…

You can never have a single great idea in your life, but become skilled in executing the great ideas of others, you can succeed beyond your wildest dreams. Seek them out and make them work. They do not have to be your ideas. Execution is all in this regard.

Increase your surface area for serendipity

The only truth about luck, good or bad, is that it will change. The law of averages virtually guarantees it.

…

Luck is preparation multiplied by opportunity. Say it again. Learn it off by heart. Let it become a daily mantra. Luck is preparation multiplied by opportunity.

…

“Luck is preparation multiplied by opportunity.” — Seneca

…

All around us, every day, opportunities to get rich are popping up. The more alert you are, the more chance you have of spotting them. The more preparation you have done, the more chance you have of succeeding. The more bold you are, the better chance you have of getting in on the ground floor and confounding the odds. The more self-belief you can muster, the more certain will be your aim and your timing. And the less you care what the neighbors think, the more likely you are to take the plunge and exploit an opportunity.

…

Chances come to everyone in life, in all shapes and sizes, often disguised, and more often radiating risk and potential humiliation. Those who are prepared to analyze the risk, to bear the humiliation and to act in deadly earnest—these are the “lucky” ones who will find themselves, when the music stops, holding a potful of money.

…

I have watched my own idiocy transformed by a piece of good fortune. I have stood, amazed, as catastrophe transformed itself into another chance—or, even more ridiculously, into a home run. And I have witnessed genuine achievement and hard work undone by a series of astonishingly unlikely events—mostly in others, I hasten to add.

Employment is means to an end

Working too long for other people can blunt your desire to take risks.

…

Working for others is a reconnaissance expedition; a means and not an end in itself. It is an apprenticeship and not a goal.

Commitment is paramount

Until one is committed, there is hesitancy; the chance to draw back; always ineffectiveness concerning all acts of initiative and creation. There is one elemental truth, the ignorance of which kills countless ideas and splendid plans: that the moment one commits oneself, Providence moves all. All sorts of things occur to help one that would never otherwise have occurred. A whole stream of events issue from the decision, raising in one’s favor all manner of incidents and meetings and material assistance which no one could have dreamed would come his or her way.

Decisions trump debates. Don’t overthink.

But prompt decisions and orders, right or wrong, are far healthier than endless debate and prevarication. This applies equally to a debate within one’s own mind. Fretting is counterproductive at any level.

…

But there is a downside to all this intelligence and imagination. He thinks a little too much before he acts. He weighs the options too carefully. He is capable of imagining defeat.

The right market matters a lot

If you wish to be rich, you must grow a carapace. A mental armor. Not so thick as to blind you to well-constructed criticism and advice, especially from those you trust. Nor so thick as to cut you off from friends and family. But thick enough to shrug off the inevitable sniggering and malicious mockery that will follow your inevitable failures, not to mention the poorly hidden envy that will accompany your eventual success.

a note of caution. Those who can never be rich may not want you to become rich. That’s an ugly thing to say, but unless you realize and accept that you cannot be “one of the boys,” that your bosses and you are not “in this thing together,” that only those who refuse to be conned by the idea of “team spirit” in the workplace can succeed—unless you come to fully comprehend and understand all this, then you will only make other people rich.

To get rich, you will need capital, and to acquire capital you need to be where loose capital is searching for a home.

…

New or rapidly developing industries, whether glamorous or not, very often provide more opportunities to get rich than established sectors. The three reasons for this are availability of risk capital, ignorance and the power of a rising tide.

…

Swimming with the tide rather than against it, so to speak. A swelling tide raises all boats, including yours.

… the combination of ignorance and misconception that surrounds any new market or technology works in your favor. If you are quick at grasping concepts and jargon, you become an “instant expert.” The owners of capital love “experts.”

…

the power of a rising tide masks many start-up difficulties, putting individuals and small companies on a more even footing with conglomerates and established operators; for a while, at least.

… As a general rule of thumb, then, growing industries with relatively low start-up costs offer more opportunities for those who want to get rich than declining industries, or those that require huge start-up investment.

… A sizable fish in a growing sector, however small, is more attractive to prospective purchasers and investors than the same size fish in a diminishing or static pond.

Ownership is a necessity

The biggest rewards go not to those individuals who came up with the idea, nor to those individuals who built the empire. They go to those entities or individuals who funded the enterprise and own the most stock.

…

An understanding and passionate affinity with any subject, in combination with effective management, sales and marketing techniques, could well provide a tailor-made solution to the Search.

Most of us have to beg for capital

There are only six ways of obtaining capital.

You can be given or inherit it;

you can steal it;

you can win it;

you can marry it;

you can earn it;

you can borrow it.

All are difficult. Borrowing is most likely to pay off for most.

Those who wish to start a company and get rich cannot expect a free ride. But they might be surprised at the number of fishes in their particular pond willing to help them to some degree or another.

…

If you cannot bear the thought of prostrating yourself to obtain the seed corn, then you will almost certainly never own the farm.

…

That is what it is like in the beginning. Always. It is desperate and it is humiliating. As you will find, in your own way, unless you were born with a rich mommy or daddy or uncle. For the rest of us, if you want to be rich, then you must walk a narrow, lonely road to get the capital to make it so.

Cashflow is the heartbeat of your business

Facing up to cash-flow demands and refusing to succumb to the “ostrich syndrome” is a paramount concern in any start-up. You can delegate many tasks when creating a new business, but monitoring and forecasting cash flow is not one of them. It’s your responsibility and your task. Nobody else’s.

…

Lose control of a business by running out of cash and you are relegated to the status of minority investor or salaried employee. Once you lose control of a business, then no bank, white knight, investor or new owner is likely to permit you to gain control again, if for no other reason than that of your original sin, your overoptimism concerning the venture’s cash flow in the first place.

…

Factoring debt is like smoking cigarettes. You know perfectly well that smoking leads to death—but that death, however appalling, is some way off. And you need a cigarette now!

…

You can improve cash flow by observing the following suggestions in a start-up’s early days:

• Keep payroll down to an absolute minimum. Overhead walks on two legs.

• Never sign long-term rent agreements or take upmarket office space.

• Never indulge in fancy office or reception furniture, unless your particular business demands that you make such an impression on clients.

• Never buy a business meal if the other side offers to. You can show off later.

• Pay yourself just enough to eat.

• Do not be shy to call customers who owe you money personally. It works.

• In a city, walk everywhere you can. It’s healthy and sets a good example.

• Check all staff travel and entertainment claims with an eagle eye.

• If you’re going to be late paying, call the vendor’s boss. Give a date. Stick to it.

• Always meet payroll, even at the expense of starving yourself that week.

• Issuing staff credit cards, company cell phones or cars is the road to ruin.

• A vase of beautiful flowers in reception every week creates a better impression than £100,000 worth of fancy Italian furniture.

• Get used to groveling. Groveling is an effective tool in a start-up’s cash flow.

• They want your business. Play one supplier off against another. Ruthlessly.

• Only enter a factoring deal in absolute extremity. Exit it fast.

• Keep your chin up. It could be worse. You could be working for them.

Persist. Pivot if you must, but don’t give up

Reinforcing failure sounds so easy to avoid. If something fails, stop doing it and start doing something else, right? Er, right. Except, just when do you decide that you have a “failure” on your hands? Too late, is the answer—always too

…

My own suspicion is that many failures are merely a matter of timing. What used to fail now succeeds. What once was a sure thing now no longer works.

…

“Persistence” is a vital attribute for those who wish to become rich, or who wish to achieve anything worthwhile for that matter. As is the ability to acknowledge that one has made a mistake and that a new plan of action must now be made. Any such acknowledgement is not a weakness, it is a sign of clear thinking. In its way, it is a kind of persistence in itself. Try, try, try again, does not mean doing what has already failed, over and over again. Quitting is not dishonorable. Quitting when you believe you can still succeed is. You must keep the faith. Belief in yourself and faith in your project can move mountains. But not if you insist on trying to scale the mountain by an impossible route which has already failed.

…

Do not be afraid to change tack, alter course or make new plans with whatever you are attempting to achieve. Especially if you sense that you are on the wrong track. Above all, avoid banging your head against the same piece of wall. The wall will not get any softer. And don’t give up—if you want to be rich.

…

Self-believe, with full confidence

If you want to be rich you must work for it. But you must believe in it, too. You must believe in yourself, if only to armor yourself against the laughter of the gods in your quest. Your mad quest to be rich.

…

Persistence is not quite as important as self-belief. I have known people who believed in themselves, who acted on that belief, got lucky quickly and got rich. Persistence merely offers a second or third bite at the cherry. Your belief in yourself brought you to the cherry bowl in the first place.

…

Without self-belief nothing can be accomplished. With it, nothing is impossible. It is as brutal and as black and white as that.

…

There is nothing wrong with doubt, or with fear. They are immensely useful tools. But you either learn to incorporate them into your thinking and your life, or you will be ruled by them. There is no “middle way.”

…

It is doubt multiplied by the fear of failure, unconfronted, which leads to the creation of a vicious cycle where self-belief is eroded and nothing is achieved. Doubts can and should be confronted, as should fear. This is best done in daylight, under rigorous examination. (Three o’clock in the morning is a difficult time to confront any such messengers.) Write down your doubts and fears. Examine them. Hold them up to the light. Suck the wisdom out of them and discard their husks in the trash.

…

It is the instinct to seize an opportunity when it presents itself that perhaps sets apart the self-made filthy rich from the comfortably poor, the willingness to ignore conventional wisdom and risk everything on what others consider to be folly.

Think big. Act small

Most of the worst errors I have made in my life came from forgetting to act small. It’s hard to do when you’re rolling around in coin and everything is going your way. But acting big leads to complacency, and complacency is the reason that many successful start-ups falter.

…

Every day you have to hit the ground running, putting in more hours than even your most dedicated member of staff. You have to stay flexible. You have to be willing to listen and to learn and to emulate success elsewhere. If you don’t, if you think you have already made the cut, if you’re thinking “game over: time to party,” then bad stuff begins to happen very quickly.

…

Think big, act small. It’s a recipe that never goes out of style. While especially important for start-ups, it will serve you faithfully long after you have established yourself as a serious player. A successful and naturally modest entrepreneur is an object of reverence and respect in the business world. Even if such a fabulous beast is rarer than hens’ teeth.

Find and hire great talent

…

Anybody wishing to become rich cannot do so without talent. Either their own, or far more likely, on the back of the talent of others. Talent is indispensable, although it is always replaceable. Just remember the simple rules concerning talent: identify it, hire it, nurture it, reward it, protect it. And, when the time comes, fire it.

Talent is the key to sustained growth, and growth is the key to early wealth. You have to identify and hire talent. You can’t skimp on it.

…

When you come across real talent, it is sometimes worth allowing them to create the structure in which they choose to labor. In nine cases out of ten, by inviting them to take responsibility and control for a new venture, you will motivate them to do great things.

…

Talent is usually conscious of its own value. But the currency of that value is not necessarily a million-dollar salary. The opportunity to prove themselves, and sometimes the chance to run the show on a day-to-day basis, will often do the trick just as well. This holds true even if talent is placed in the driver’s seat of a small division within an existing operation. What talent seeks, as often as not, is the chance to prove itself and the opportunity to excel.

Develop and trust your instincts. Adapt no matter what!

As you will discover when you start your own business, it’s difficult and scary facing up to swiftly changing realities on the ground. Most of us would prefer that things stayed the same so that we can carry on making money in the way we have grown comfortable with. But things do not stay the same. Either you learn to go with the flow and change as rapidly as you are able, or you will be left stranded, like the last dinosaur, by the last warm lake, on the last continent the ice age has yet to reach.

…

Trust your instincts. Do not be a slave to them, but when your instincts are screaming, Go! Go! Go! then it’s time for you to decide whether you really want to be rich or not. You cannot do this in a deliberate, considered manner. You can’t get rich painting by numbers. You can only do it by becoming a predator, by waiting patiently, by remaining alert and constantly sniffing the air and by bringing massive, murderous force to bear upon your prey when you pounce. You can share the kill later, by all means. But if you want to get rich, trust your own judgment when it calls—and leave those whose job it is to manage your business to pick up the pieces. They can have the scraggy bits. But the heart and liver are yours.

…

The “feeling” is when the hair rises slightly on the back of your arms and neck and you know you are on the scent of something you shouldn’t be doing— but you’re going to do anyway. It’s called commercial instinct. You develop it over the years. You certainly aren’t born with it.

Strangling your own baby, in order to grow, is far more common than you might think. If you have a successful monthly magazine, for instance, and then launch a weekly in the same category, you will inevitably weaken sales of your original title. This will follow as surely as night follows day. So should you launch the weekly magazine? Yes! A thousand times yes! Why? Because if you do not launch the weekly edition, even though you know it is a good idea, then your rivals will do it for you. You will then be left with a damaged monthly and no weekly.

…

This is called the “Barbarians at the Gate” principle. Let’s imagine you have a herd of sacred cows inside a fortress. The barbarians are at the gate and you are under siege. Killing sacred cows is a horrible crime, even though your defenders are running short of food. If the barbarians overrun the fortress, the sacred cows will die anyway. If you kill some of the cows, you will be stronger and possibly able to turn back the barbarian attack. Ergo, you eat one or two sacred cows—even if those same cows were the meaning of life last week. Learning to evolve or die is a cardinal virtue.

Once you win, diversify

During the start-up, you concentrate on that one basket as if your life (and the life of your firstborn) depends upon it. But once you have something that’s working and making some money, start looking around quickly for another opportunity. The more baskets the better.

…

Diversifying not only ensured that I had more chances to lay more eggs and somewhere to incubate them, it also gave me the confidence to concentrate on any one egg at any one time. When one of my projects was in trouble and needed more work, or needed rethinking, the fact that I had other eggs in other baskets gave me the confidence to do what was right. Like reengineering or folding it.

A few tips on staying rich

- Never go on vacation when a deal is going down.

- When you change accounting systems (or accountants, for that matter), have the numbers checked over and over again. I’ll eat my hat if errors are not discovered in the next iteration.

- Never personally underwrite business loans for your company unless you absolutely, positively, are forced to. Even then, set limits in the agreement so that, as the loan figure is reduced over time, you are released from your undertakings commensurately.

- Listen to people who are good with money and always invest in property with a good address—providing you can pay cash for it and will not need to sell it for a few years.

Negotiation is about the balance of weakness

Most of us are rather poor negotiators.

• Most negotiations are unnecessary. • “The other side” is often just as smart (or stupid) as you are. • In the end, “the balance of weakness” almost always decides the issue. • In Greed vs. Need, the former usually “wins.”

…

If you need a loan because you cannot meet payroll, you almost certainly won’t get one. (Er, make that “you absolutely, definitely won’t get one.”) The balance of weakness is so obvious and utterly immediate, nobody will want to waste time listening to your entreaties. But if you need a loan, say, because you wish to take a private company public with a reasonable chance of success in the not-too-distant future (in other words, you don’t really need a loan, it would merely be convenient to be offered one), then loans will shower upon you like confetti.

Farmers are poor negotiators. Supermarket chains are great negotiators. Supermarkets have a lot of cash and many possible sources of supply. Farmers need to fix that broken tractor and pay their veterinary bills right now. The balance of weakness is overwhelmingly in the farmers’ camp and the result is therefore preordained unless central government interferes.

…

Supermarkets have a slight weakness—very slight. They need to buy food regularly and in wholesale quantities. And they need quality and consistency. If food became scarce, the balance would tilt and farmers would begin to clobber the supermarkets. But, right now, farmers haven’t a prayer. There is too much food of reasonable quality too consistently available from too many sources and our government has chosen not to interfere.

…

Serious negotiations are very different from day-to-day bargaining and should be approached differently. They imply a weakness in the position of at least one of the parties involved in the negotiations, unlike day-to-day bargaining, where no such weakness need exist. The first thing to be done, perhaps the most vital thing, is to establish exactly where those weaknesses lie. Weaknesses in serious negotiations usually exist in both camps, of course, at least to some degree or another, and it becomes important to swiftly determine which weakness is most pressing and most potentially catastrophic to which party. An immediate balance of weaknesses may well prove more decisive than any long-term balance of strengths.

Flea can beat the Elephant

• The flea has established to his own satisfaction the elephant’s urgent need.

• The flea has learned to ignore flattery.

• The flea has learned that an elephant cannot be your friend in negotiations.

• The flea has learned he is not a good negotiator.

• The flea has learned to “empty” himself and make himself believe he does not care.

• The flea has overcome his lack of skill by setting a price he will not deviate from.

• The flea has hardened his heart and has walked away when the price was not met.

• The flea has introduced a rogue element (the trade magazine) into the negotiations.

• The flea has weighed Greed vs. Need. He believes Need will outweigh Greed.

…

There is more than one elephant in any jungle. Which is just as well. Fleas stand little chance when there is only one elephant—monopolies and entrepreneurs don’t get along.

…

The flea has also learned to shrug off flattery and keep his eye on the balance of weakness. This particular elephant has a huge need, almost a unique need, and the flea is determined to exploit it.

…

What do institutional investors in huge corporations have to do with developing serious negotiating skills as an entrepreneur and getting rich? Everything, my friend. Everything. For the elephant must show his master that he is an up-to-date elephant. A savvy elephant. An elephant that knows what’s just around the corner and what the next big thing is going to be in his patch of jungle. Otherwise he risks his share price dropping and being hurt by the nasty iron stick, or even shot by the fierce institutional investor, who will then acquire a new elephant, leaving the bones of the old one to rot on the jungle floor. Now you have had an idea. You have nurtured it with your little company and it is now a reality, however tiny. Better still, it looks like it’s already working, or might work soon. The elephant is concerned that his master may hear of this little flea’s idea and that he might well be punished for not having thought of it himself. (Most elephants are a trifle lazy, you know.) The elephant knows what he must do then. He lumbers over to meet you. He has done it many times before, with many other fleas. Thus it is that the elephant comes to the flea—not because he wants to (in his monstrous, corporate heart he would really like everything to stay the same), but usually because he fears his mahout more than he despises the flea. And sometimes, too, to be fair, because elephants are as curious as the rest of us. But never forget why he came calling in the first place. He does not love you. He is not your friend, although he may pretend to be. He might not hate you, he may even admire you a little. He will certainly flatter you. But remember he had to come. His fear drove him. His fear of his master, the institutional investor. And the day when he does come—hurrah!—the day when he makes that hateful call—hateful to him, that is—that is the day when the fun begins and when serious negotiating skills and a dispassionate understanding of the balance of weaknesses in your particular patch of jungle, at that particular time, can change your life overnight. And can change it for ever. Just as it changed mine.

…

Remember that few of us are any good at detailed negotiations. That includes your opponent, by the way. > • If you are a poor negotiator, like me, then set a limit on what you will pay or accept and on any conditions attached. Do not deviate. Your first thought is your best thought.

• Most negotiations are unnecessary. Don’t enter into them. Remember that “the fortress that parleys is already half taken.” Save serious negotiations for serious occasions.

• Do your homework. And do it rigorously. What you don’t know or haven’t bothered to find out can kill you in any type of serious negotiation.

• Despite my jungle book examples above, the devil really is in the detail in serious negotiations. Get all the professional help you can trust. But do not surrender control of the negotiations or the agenda to such professionals. They are not the ones who will have to live with the consequences—you are. Professional advisors are there to explain and advise, not to decide.

• If your advisors are leading you down a path you don’t approve of during your negotiations, call a “time-out” and tell them privately that if they continue along that route you will get yourself some new advisors. The world is full of them.

• Never fall in love with the deal. A deal is just a deal. There will always be other deals and other opportunities.

• Avoid auctions in business like the plague—unless you are selling something, that is. You will nearly always pay more than is wise if you are the “winner” of an auction process.

• The negotiator opposite you is not your new best friend. He is not your partner. He is not your confidant. You have no obligation, outside of ordinary courtesy, to please him or satisfy his demands. He is the enemy. If you do not understand that real winners and real losers emerge from serious negotiations, then you will be robbed, whatever the circumstances.

• Take no notice of management manuals that tell you to leave passion and emotion out of the negotiating room. If you are emotional or passionate about something, then let it show. But leaven emotion with courtesy, and, if possible, with wit. If you’re not the witty type, then flattery and self-deprecation are good substitutes.

• Listen when engaged in serious negotiations. Then listen some more. You are in no hurry. Nobody ever got poor listening. Also, use silence as a weapon. Silences are disconcerting. People tend to fill silences with jabber, often weakening their bargaining position as they do so.

• Choose a rogue element to your advantage and bring it into the negotiation at a late stage. You’ll be amazed at how often this tactic produces results.

• The British created the largest geophysical empire in the world with one tactic: divide and rule. It always works. It never fails if you can get to exploit it. Get to know the other side. There may be slight differences in the individual approaches of their senior managers and, possibly, in their goals. Drive a wedge and keep hammering.

• Permit no such weaknesses in your own camp. I have often banned senior executives from taking part in negotiations simply t oavoid this trap. Better you are in there on your own, outgunned, outflanked and outmaneuvered, than to have two or three of you silently squabbling.

• Everyone thinks they are a great negotiator, but most of us simply are not. If it’s your company, then, for better or worse, you are the final arbiter. That remains true whether you are a good negotiator or a bad one.

• If you suspect you perform badly on such ocassions, do not attend, even if you are the 100 percent owner. Get someone else to do it after setting out your response to every conceivable option that might arise. This tactic can be devastating to the other side. You have to trust your nominee completely, though.

• Above all, establish where the balance of weakness lies in any serious negotiation. Most strengths are self-evident, especially strengths like cash and infrastructure. Weaknesses are usually hidden. Ferret them out, hold them up to the light and make a battle plan.

• Whatever you agree to during a negotiation, fulfill the bargain. Nobody wants to do business with a weasel or a chisler. Written in the Zoroastrian Scriptures two-and-a-half thousand years ago was this: “Never break a covenant, whether you make it with a false man or a just man of good conscience. The convenant holds for both, the false, and the just alike.”

Don’t manage. Lead.

You may well have to masquerade as a manager (for a short while) on the way to becoming rich, and you should strive to be a good manager while the role is forced upon you. But even if you discover that you truly have a talent for the minutiae that management demands, it’s best to abandon the role just as soon as you can afford to hire appropriate personnel. You just will not have the time to choose who gets to work in which office, where the Christmas party should be held or what company policy should be regarding the provision of in-house tea and coffee facilities. If, as the owner, you do find you have the time to involve yourself in such decisions, then I have news for you. Your organization is in deep trouble.

…