How The Economic Machine Works by Ray Dalio

TLDR; Rules to follow

- Don’t have debts rise faster than income. You’ll get crushed if your debt rises higher than your income.

- Don’t have income rise faster than productivity. You’ll become uncompetitive if you let your income rise faster than productivity.

- Do all that you can do to raise productivity. In the long run, your productivity is what matters the most.

The forces of economy

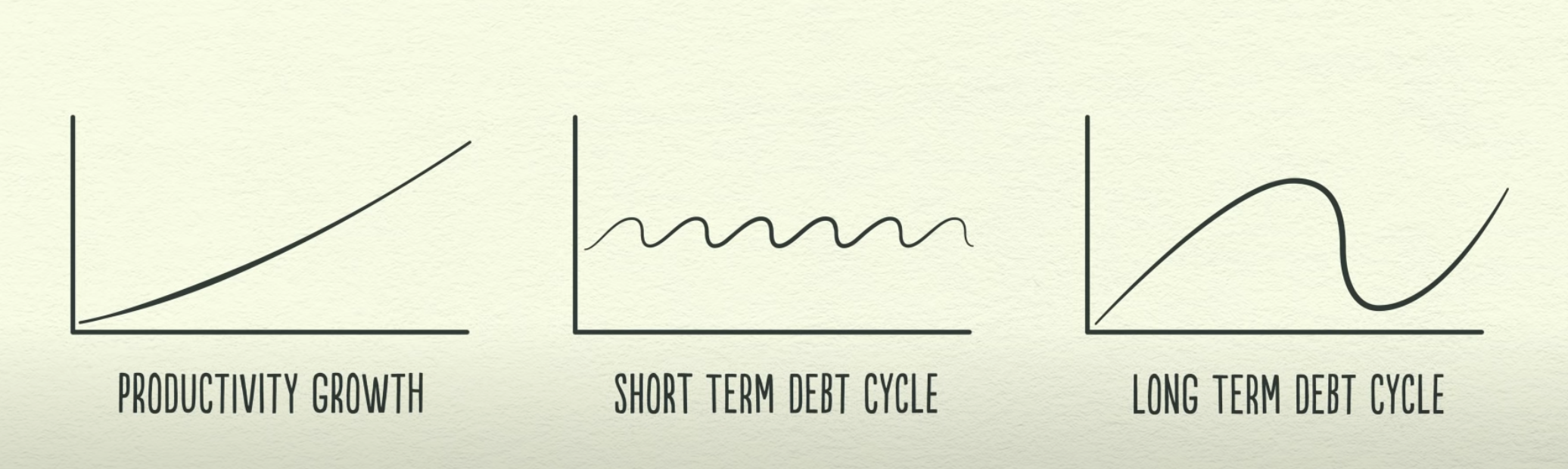

The economy is driven by 3 main forces:

- Productivity Growth

- Short-term debt cycle

- Long-term debt cycle

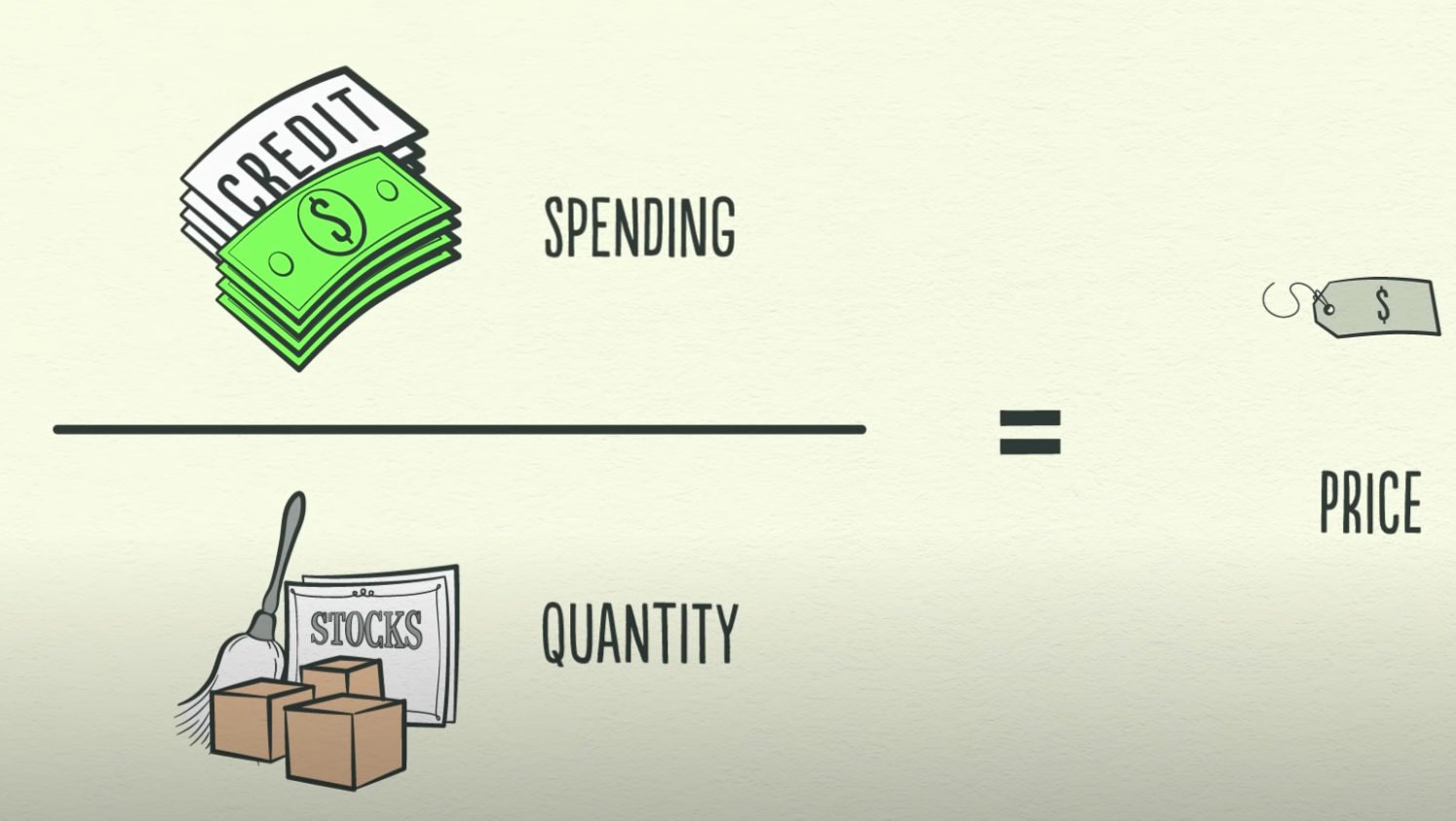

A transaction is exchanging money and credit for goods, services, and financial assets like stocks.

A price is determined by the total spending and total goods, services and financial assets produced.

A market is a group of buyers and sellers making transactions for the same thing.

Insight Spending drives the economy. One person’t spending is another person’s income.

Credit

Credit is the biggest and most volatile part of the economy. Most of what people call money is credit.

It’s primary actors are lenders and borrowers. The goal of lenders is to make more money. The goal of borrowers is to buy something they can’t afford (house, car, start a business).

Borrowers pay back the initial amount called principal plus an additional amount called interest.

Insight Borrowing is inversely proportional to interest rates. When interest rates are high, there is less borrowing because it’s expensive. When interest rates are low, there’s more borrowing because it’s cheaper.

When borrowers say they’ll pay back the lender and the lender believes them, credit is created! Celebrate

As soon as credit is created, it immediately turns into debt.

Insight Debt is an asset to the lender and a liability to the borrower.

When a borrower gets credit, he can increase his spending, which increases someone else’s income.

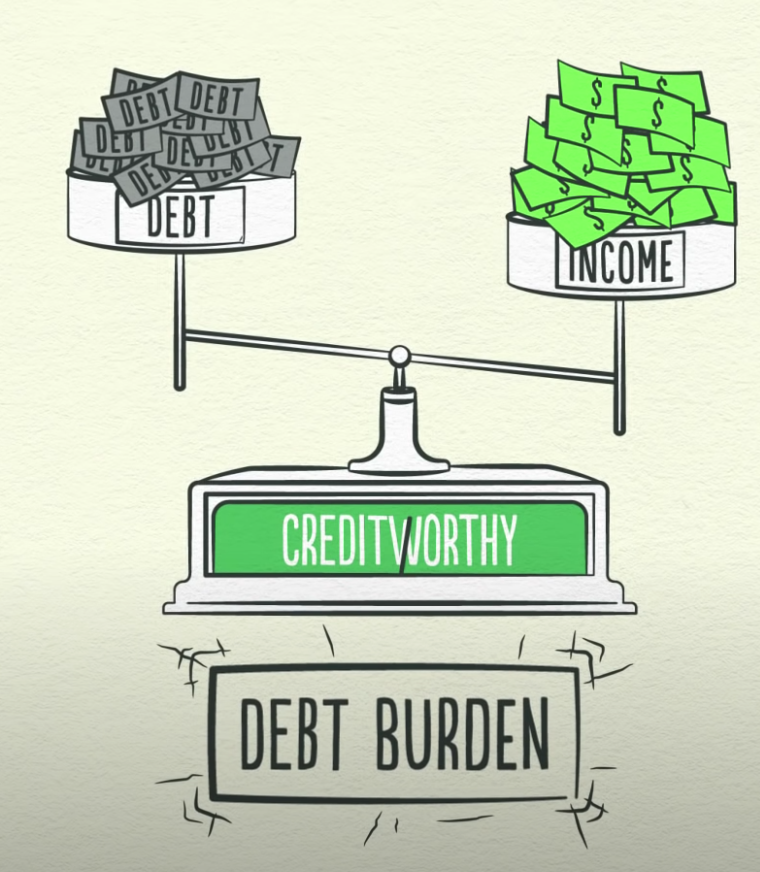

When your income increases, you become worthy of more credit. A credit-worthy borrower has 2 things, the ability to repay, and collateral.

Insight Increased income allows increased borrowing which allows increased spending. This leads to self reenforcing pattern of economic growth and is why we have cycles.

Productivity Growth

Accumulated knowledge raises our living standards. Those that work hard tend to live better than those that don’t. However, that isn’t necessarily true in the short-run.

In an economy without credit, the only way to increase spending is by producing more. In an economy with credit, you can also increase your spending by borrowing.

Insight Productivity matters most in the long run. Credit matters most in the short run.

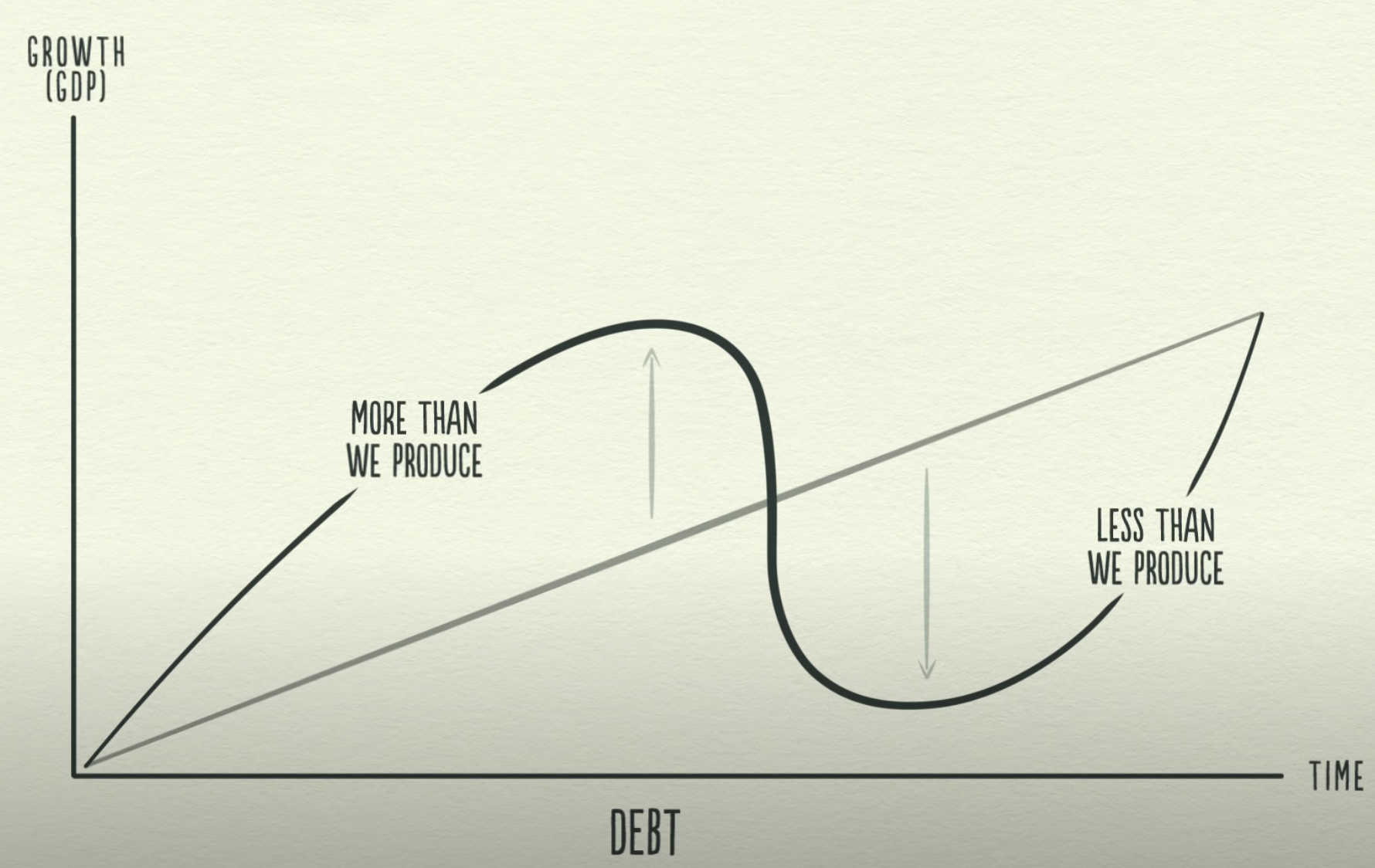

Debt is a big driver of economic swings because it allows us to consume more than we produce when we acquire it and it forces us to consume less than what we produce when we have to pay it back.

Insight Borrowing leads to cycles. It is effectively a way to increase spending today by reducing spending one some future day (pay back day).

Money leads to instant settling of a transaction. Credit is a promise to settle (with money) in the future and is enforced by debt liability to the borrower and a credit asset to the lender.

Short-term Debt Cycle (every 5 - 8 years)

Insight Interest rates on credit are controlled by the Central Bank.

Spending, fueled by credit, increases and prices rise. This is called inflation.

Seeing prices rise, the Central Bank raises interest rates, with the aim to reduce borrowing, which should reduce spending. Because spending is another person’s income, this also leads to reduction in income.

When people spend less, prices go down. This is called deflation. Economic activity decreases and we have a recession.

If the recession becomes too severe, the central bank decreases interest rates in order to entice borrowing and start the cycle all over again.

In the short-term debt cycle, spending is constrained only by the willingness of lenders and borrowers to provide and receive credit.

Insight When credit is easily available, there’s an economic expansion. When credit isn’t easily available, there’s a recession.

Long-term Debt Cycle

Each short-term debt cycle finishes with more growth than the previous cycle and with more debt because people push it - they have an inclination to borrow more and spend more than to paying back debt. It’s human nature.

Because of this, over longer period of time, debts rise faster than incomes. Since the economy appears to be growing, incomes are rising, stock market soars, confidence is high, so lenders more freely extend credit and borrowers keep borrowing more and more.

When people do a lot of the above, we call it a bubble.

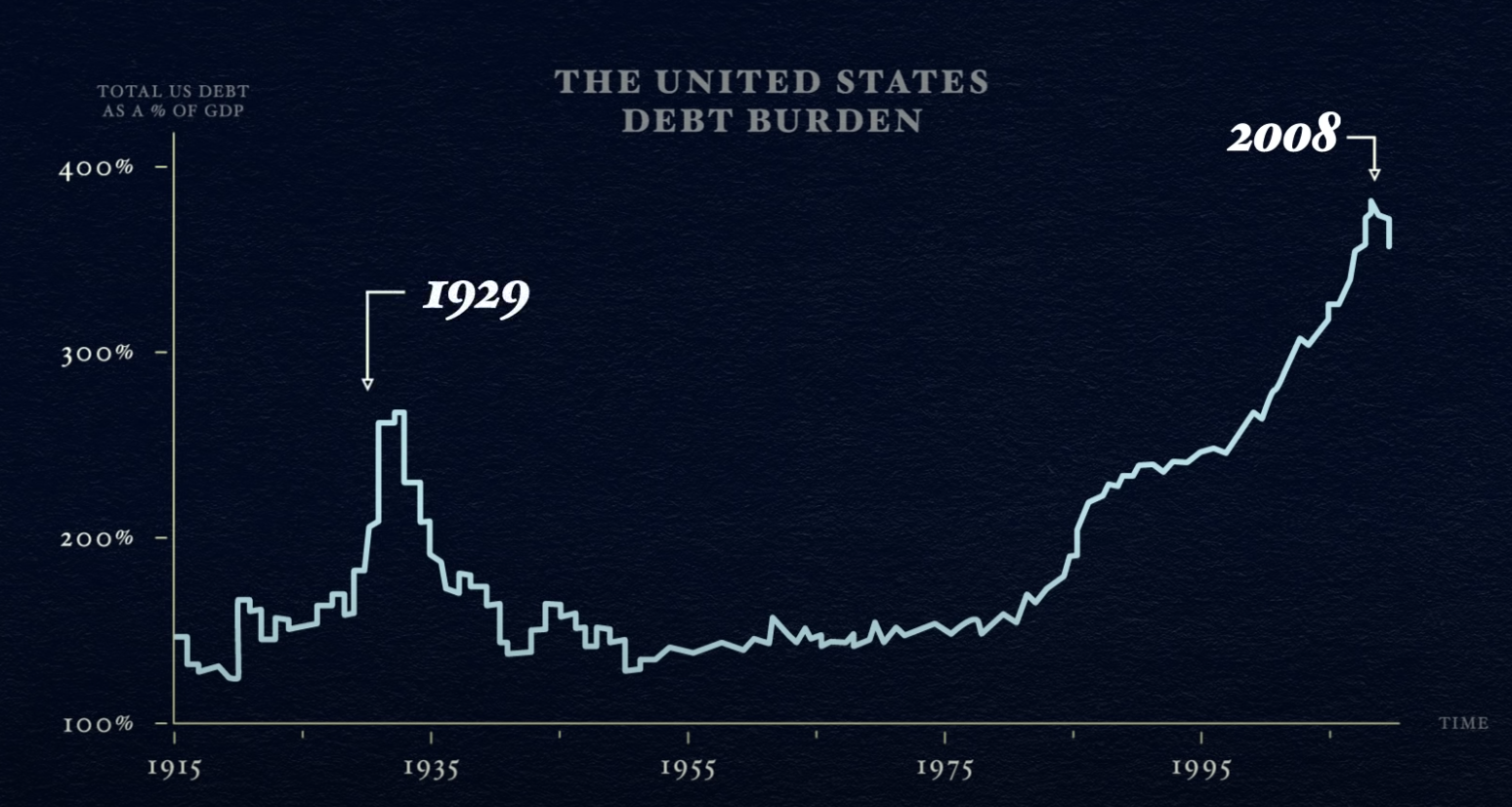

The ratio of debt to income is called the debt burden. As long as incomes continue to rise, the debt burden stays manageable.

This allows people to buy investments with borrowed money. Even with growing debt, due to income rising and borrowers accumulating assets that can be used as collateral, they remain credit worthy.

Over decades, debt burden slowly increases, creating larger and larger debt repayments. This leads to less spending. Since one person’s spending is another person’s income, incomes start decreasing. This makes people less credit worthy, causing borrowing to go down. Thus the cycle reverses.

The last two peaks of the long-term debt cycle in the US are shown below:

This leads the economy to deleverage.

In a deleveraging:

- → debt repayments rise

- → borrowers get squeezed

- → people cut spending

- → incomes fall

- → people lose credit worthiness

- → credit disappears

- → borrowers cannot borrow enough to make debt repayments

- → borrowers sell assets

- → asset prices drop

- → rush to sell assets and reduction in spending leads to stock market crashes

- → real-estate market tanks and banks get into trouble

- → drop in asset prices reduces value of collateral which leads to further reduction in credit worthiness

- → social tensions rise

- → cycle repeats

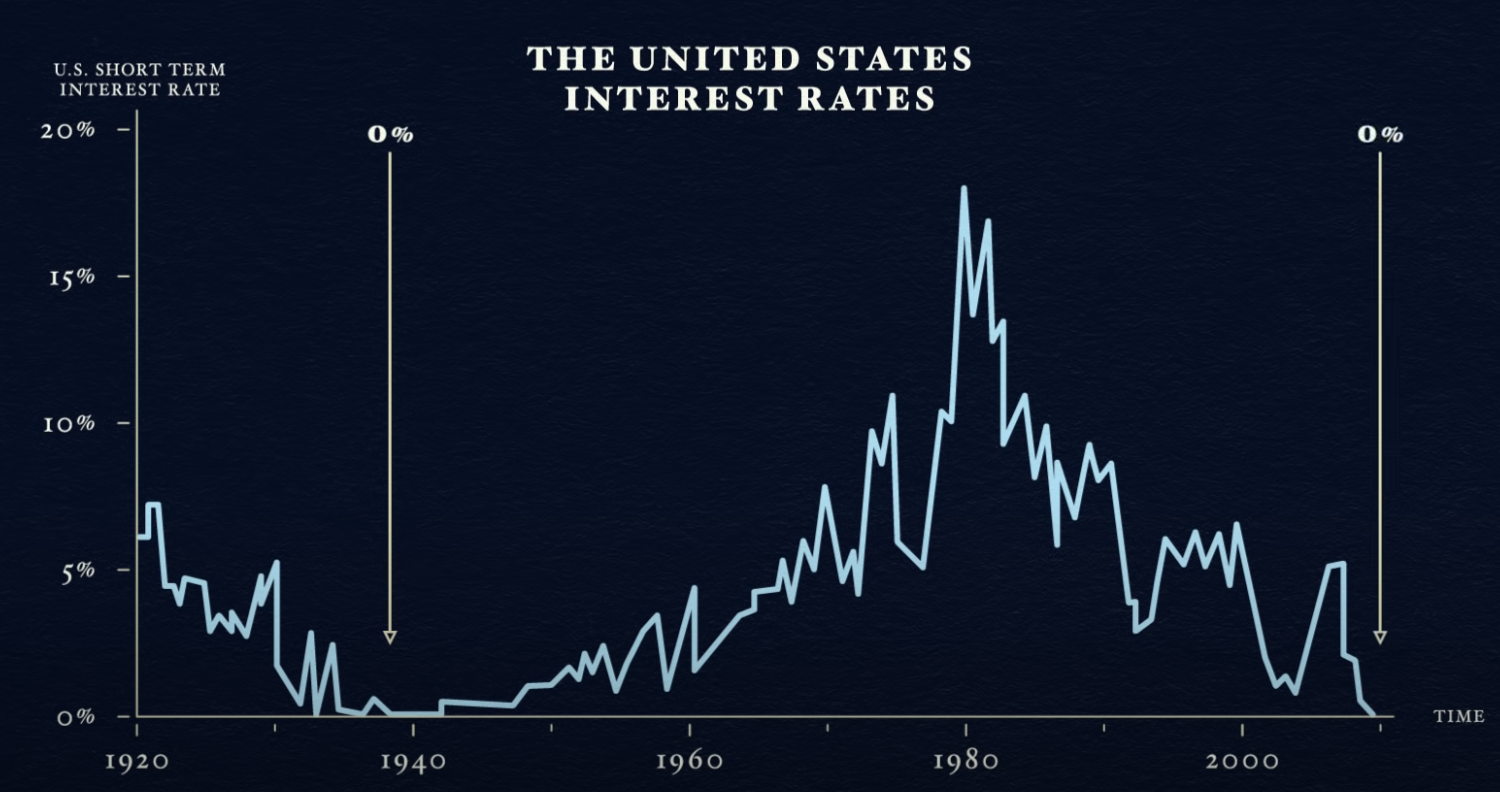

This is the same as a recession except interest rates can’t be lowered to save the day because interest rates were already low.

In a deleveraging, interest rates hit 0%.

This happened in US at the peaks of the previous two long-term debt cycles.

The borrowers debt burden simply became too big and can’t be relieved by lowering interest rates.

Lenders realize debts are too large to ever be paid back. Borrowers lost the ability to repay and their collateral has lost value. Lenders stop lending, borrowers stop borrowing → the whole income becomes not credit worthy.

How to reduce debt-burden?

There are 4 ways:

- People, business, and governments cut their spending (deflationary)

- Debts are reduced through defaults and restructurings (deflationary)

- Wealth is redistributed from the have’s to the havenot’s (deflationary)

- Central Bank prints new money (inflationary)

These 4 ways have happened in every deleveraging in modern history.

Usually spending is cut first so that people, business and governments can pay back their debts. This is called austerity.

This cases incomes to fall faster than debts are repaid and the debt-burden actually gets worse.

This leads to an economic depression.

The next step is debt restructuring. This is essentially the change in debt agreements to be paid less, or over a longer period of time, or with lower interest rates. Bottom line is that lenders would rather get paid a little of something than all of nothing.

People with less income pay less taxes. At the same time, more people are unemployed and need government help. This causes the government to spend less than it earns, leading to a budget deficit.

To fund the deficit, governments can either raise taxes or borrow more. One way they do this is by raising the tax on the wealthy.

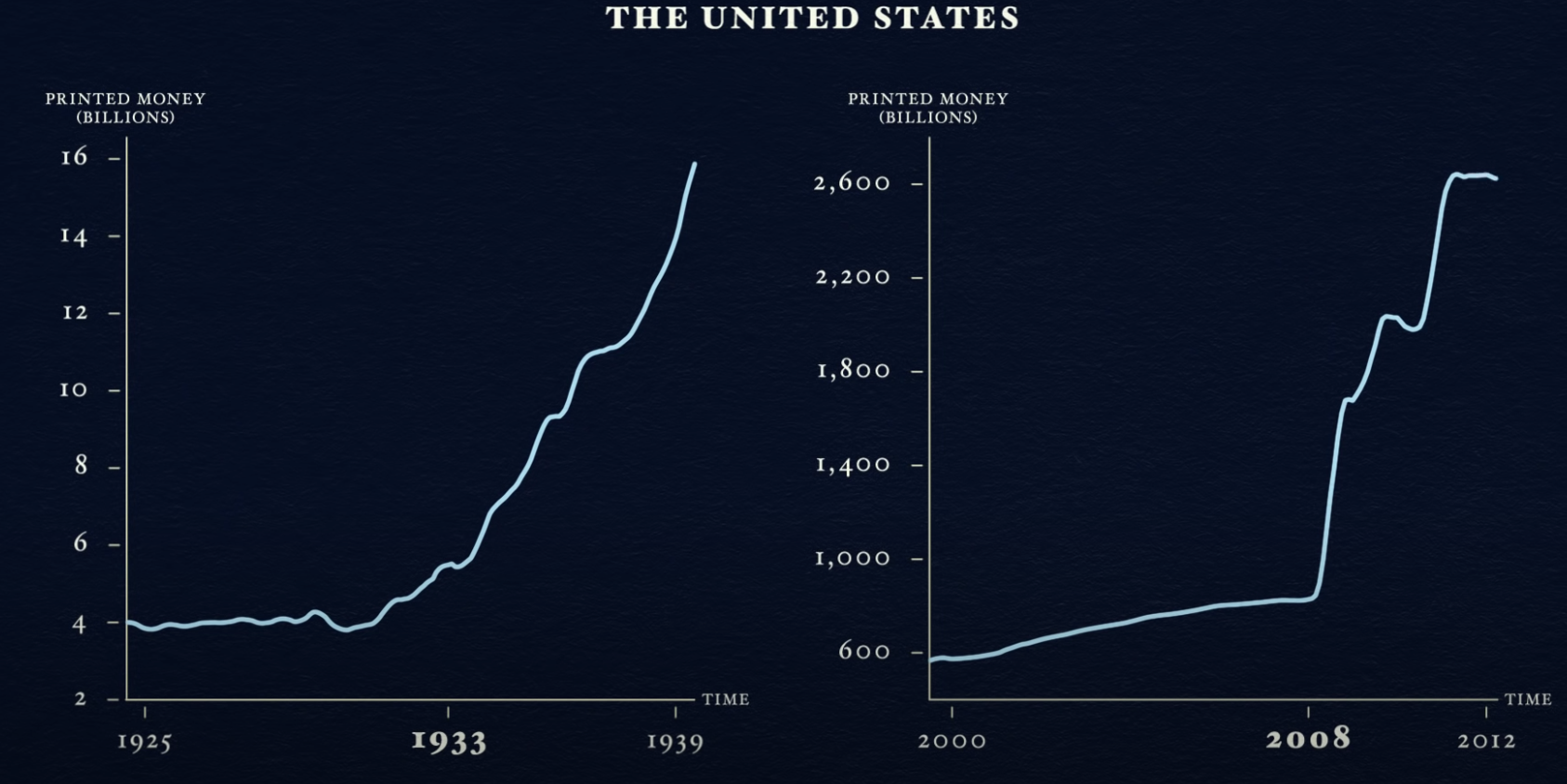

The next step is for the Central Bank to print more money. This has happened in US during the great depression and again in 2008.

The Central Bank prints money and can use it only to buy financial assets, such as government bonds. This means that the Central Bank lends money to the government, allowing it to run a deficit and increase spending on goods and services through its stimulus programs and unemployment benefits. This increases people’s incomes, as well as the government’s debt.

The trick during a deleveraging is to balance the inflationary and deflationary measures!